Mortgage financing can be frustrating.

It doesn't have to be.

Here's our 3 step plan.

STEP ONE

Get in touch.

The best place to start is by letting us know who you are! Click the start here button below and you'll be directed to a page where you can complete an online application, schedule a meeting to discuss your financial situation, connect with us on the phone, or send us a quick message.

STEP TWO

Walk through the process together.

Our experienced staff have mastered the mortgage process. Let us guide you through getting the best mortgage product for you!

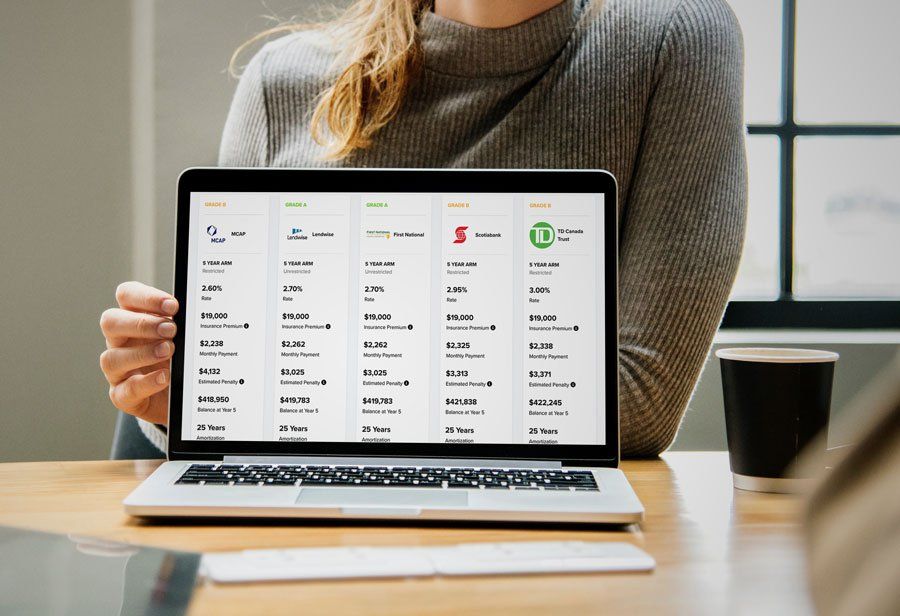

In

our online portal

you'll be able to do the following:

- Upload all of your documents in one place (paperless)

- Add your real estate agent and lawyer (collaborating saves time)

- Compare all mortgage types and features from different lenders

- Customize the perfect mortgage to match your lifestyle

- Make calculations based on different financial scenarios

- Sign all documents online to complete your mortgage financing

STEP THREE

Accountability moving forward.

The Canadian mortgage industry can change overnight. Don’t be surprised to get a call from one of our experts with updated options when things change. We continually work to save you money at every stage of your home ownership journey.

We're committed to ensuring you have the lowest overall cost of borrowing throughout the life of your mortgage! As long as you need a mortgage, we're here to help.

Trusted by Our Clients

With hundreds of 5-star reviews, our clients are at the heart of everything we do. Each review reflects the care, expertise, and commitment our team brings to making the mortgage process simple and stress-free.

From first-time buyers to seasoned homeowners, we’re proud to have built a reputation for trust, transparency, and results. Your stories inspire us—and we’re grateful for every client who takes the time to share their experience.

When you choose us, you’re not just getting a mortgage broker—you’re joining a community that puts people first.

"I had a great experience working with indi."

"indi makes it a priority to ensure their clients are educated throughout the whole mortgage process. As a first time buyer it can be a confusing and overwhelming process – they were patient and helped me understand everything I needed to know and answered my questions."

Patricia Kopec

Put our experience to work for you

Indi Mortgage has been helping Canadians achieve their home ownership and real estate investment goals since 2001.

Welcome to our family.

We Support

YOU make it possible for us to support these organizations!

THANK YOU!

Resources to keep you learning

Sharing knowledge and empowering Canadians is in our DNA. Our blog is filled with tips, tricks and expert advice that can help you save thousands.

Our Monthly Newsletter Can Save You Thousands

Getting Started?

The best place to start the mortgage process is by completing an online application. There are no fees or commitment to do this. Once we have your application, we'll be in touch!

Make some calculations

If you'd like to run a few calculations before getting started, we'd love to help you. First tell us where you are in your journey to buying a home

I'm just getting started

Exciting times! Let's find out how much you'll be able to afford once you decide to buy.

Looking for a quick answer?

If you'd rather send a quick note to get the process started, go ahead, we'd love to hear from you.

Contact Us

Schedule a meeting.

While the best way to get in touch with us is through the online application, if you'd prefer to talk with someone, we're accessible to you!